ne smetaj bum tras kada zena radi posao za koji je placena, vidis da ima pacijeneta koji misle da je ekonomija igrica... pusti ih da resetuju englesku, bolje reset nego rusi da ih gadjajunisu to djecije bajke vec realnost...najavljen paket prije 10 dana je potopuio funtu, povlacenje jednog dijela iz najavljenog paketa je danas vratio funtu...za mene i tebe su bajke, za nekog drugog velika zarada..novog ministra financija i liz treba ne skloniti sa mjesta, vec ih strpati u zatvor...

Instalirajte aplikaciju

Kako da instalirate aplikaciju na iOS

Donji video prikazuje kako da instalirate aplikaciju na početni ekran svog uređaja.

Napomena: This feature may not be available in some browsers.

-

- Popularno:

- Bašar al Asad otrovan i u teškom stanju...

- Da li će nastaviti sa zlostavljanjem...

- Totalni rat! Zeleno levi front udario...

- Hapšenja u Moldaviji u vezi "ruskog...

- Smenjen SNS-ovac koji je napravio žurku...

- Šta se krije iza čestih incidenata...

- Da li mislite da je fakultet više...

- Nemanja Šarovic penicilin za AV i SNS⚠️

- Недоумица: зашто Вучић најављује нови...

- Koja je vaša srodna duša na forumu?

Koristite zastareli pregledač. Možda neće pravilno prikazivati ove ili druge veb strane.

Trebalo bi da ga nadogradite ili koristite alternativni pregledač.

Trebalo bi da ga nadogradite ili koristite alternativni pregledač.

Raspala se britanska funta

- Začetnik teme Samareli

- Datum pokretanja

Nikac od Rovina

Veoma poznat

- Poruka

- 10.184

Frk'ca oko funt'ce a? Aj stoe frk'ca al stoe upadljivo kol'ko globoguzi,angloguzi zaobilaze ovu i slicne tijeme pa toe...extrica

Тихи

Starosedelac

- Poruka

- 186.823

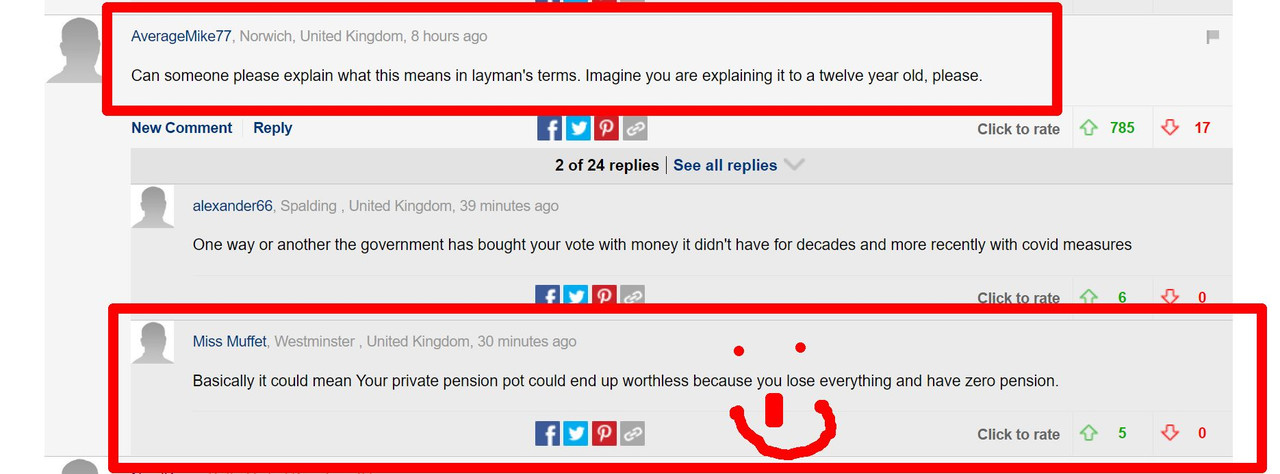

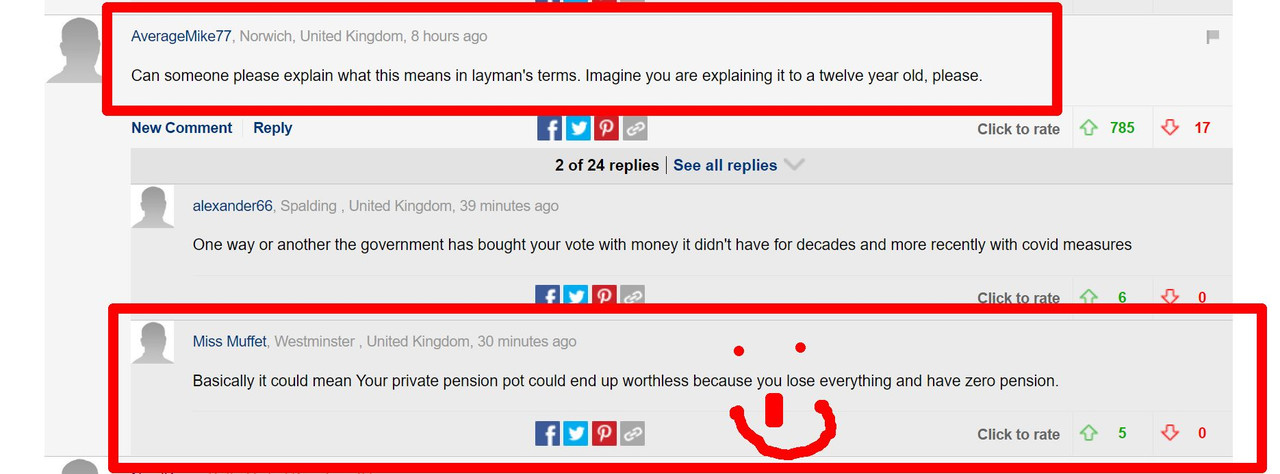

Markets brace for MORE turmoil after Bank Of England boss sent pound plunging by telling pension funds they have until Friday to balance their books and warned the current bailout will NOT continue past then

- Andrew Bailey, Bank of England governor, said it will stop support for the county's bond markets this Friday

- Pensions funds had called for the Bank's support to continue until at least October 31 and 'possibly beyond'

- Mr Bailey said this will not happen and that they need to sort out their finances and balance their books

- There was another run on the Pound after the governor's statement, as the sterling plunged against the dollar

Andrew Bailey, the governor of the central bank, faced a fierce backlash last night after he warned those managing the pensions of millions of people in the UK that they have 'three days left' to sort out their finances.

The Bank had been supporting the country's bond market in recent weeks after investors were spooked by the Chancellor Kwasi Kwarteng's 'mini-budget' last month, injecting £65billion to stop it crashing.

However, it has declined to extend this support beyond Friday, October 14, a decision that sparked more chaos last night and is set to provide stormy conditions as the market opens this morning.

Speaking at an event organised by the Institute of International Finance in Washington today, Mr Bailey said there is no plan to help stricken pension funds - which are scrambling to raise an estimated £320billion - beyond this week.

He said: 'We have announced that we will be out by the end of this week. We think the re-balancing must be done.

'And my message to the funds involved and all the firms involved managing those funds: You've got three days left now. You've got to get this done.'

That's despite calls from one pension industry body for the support to be continued until at least the end of the month 'and possibly beyond'.

The Pensions and Lifetime Savings Association said it was 'a key concern of pension funds since the Bank of England's intervention has been that the period of purchasing should not be ended too soon'.

Following the announcement by the governor, the pound plunged below $1.10 for the first time in weeks, dropping from 1.1178 to 1.0953 overnight.

This came after the Bank beefed up its earlier intervention by extending the range of bonds it will buy to include index-linked gilts – as it battled to stop a 'fire sale' that it said posed a 'material risk to UK financial stability'.

+12

View gallery

+12

View gallery

r Bailey has stressed that the programme was part of the BoE's financial stability operations, not a monetary policy tool, and had to be temporary.

The emergency action came after yields on 30-year gilts crept back towards the 5 per cent level that threatened to cripple pension funds at the end of last month. Yields on the bonds rise when prices fall.

'Things seemed calmer again today,' Bailey said, referring to conditions in the gilt market. 'We will see.'

But Andrew Sentance, a former member of the Bank's interest rate-setting monetary policy committee, branded Mr Bailey's comments last night 'another communications failure'.

Danny Blanchflower, another former rate-setter, said the Governor was now a hostage to fortune. 'I would say with the announcement by Bailey that help ends Friday, his future [is] now more in question – what if they have to step in again – he looks like a fool again?' Mr Blanchflower said.

And Viraj Patel, FX and global macro strategist at Vanda Research, rubbished Mr Bailey's claim that the Bank of England's intervention would be temporary.

He said: 'Unfortunately the BoE will learn that this is not their decision... and markets will decide for them. Even if the 'three days left' comment is true – just have these conversations behind closed doors. UK policymakers have scored so many own goals on comms.'

It comes almost two weeks after launching it to help pension funds cope with a slump in bond prices triggered by the announcement of unfunded tax cuts by the new government of Prime Minister Liz Truss.

Industry bodies have urged the Bank to keep support in place until at least Halloween when Chancellor Kwasi Kwarteng unveils his growth plan and crucial OBR forecasts.

Some fear that package will make the situation even worse as Mr Kwarteng looks doomed to a choice between eye-watering spending curbs and abandoning the government's flagship tax cuts.

In the turmoil that followed Mr Kwarteng's mini-Budget, a complicated arrangement used by many funds to hedge against inflation backfired as the prices of gilts plunged - driving up the corresponding interest rates.

They have been forced to sell other gilts in order to meet margin calls for cash from investment managers, which in turn has been pushing prices down further.

The Bank calmed the situation previously by saying it would purchase up to £65billion of long-dated government bonds, propping up the market. But the latest rout is affecting index-linked gilts, with the Bank now having to buy those as well.

'Dysfunction in this market, and the prospect of self-reinforcing 'fire sale' dynamics pose a material risk to UK financial stability,' the Bank said in a statement.

Neil Wilson, chief market analyst at Markets.com, said the Bank's third tranche of bond-buying action 'seems rather messy and panicky'.

He said: 'As expected the market was always going to retest the Bank's resolve and put the Budget to the sword.

'To expand your emergency intervention in the market once is unfortunate, to do so twice looks like carelessness.'

https://www.dailymail.co.uk/news/ar...-says-pension-funds-Friday-balance-books.html

Interesantne vesti stizu sa Zmijskog Ostrva tj iz Velike Britanije

Direktor Bank Of England izjavio da penzioni fondovi imaju podrsku do petka a posle toga su "on their own".

Sto znaci da je bankrot penzionih fondova posle petka vrlo izgledan.....

KATAKLIZMA NEOLIBERALIZMA!

Ne znam sta na ovo imaju reci @Cosmopolite @stugots @ljubota @Frtajler @De Sisti @Победоносцев i ostali neoliberalni Sorosevi talibani....

Izgleda da Rotsild, Soros i ostatak te bande gustera i zmija planira da pokrade sve penzije u Velikoj britaniji

Тихи

Starosedelac

- Poruka

- 186.823

ROKAJ KOKAJ

- Poruka

- 16.758

ekonomski tigar

MOST6

Buduća legenda

- Poruka

- 34.558

Tako je to kad izađeš iz EU-aThe pound, a unit of sterling and the currency used in the United Kingdom, has seen an enormous drop in its foreign exchange rate. Sterling is now at its weakest against the US dollar since 1985 due to low trading levels and increased borrowings while inflationary levels are increasing.

https://economictimes.indiatimes.co...ofinterest&utm_medium=text&utm_campaign=cppst

Britancima bas ne ide u poslednje vreme. Kraljica umrla, privreda hita ka dugoj recesiji a funta se raspada. Tako je to kada misli da si jos neki faktor a onda ti neko pokaze da nisi.

Frtajler

Legenda

- Poruka

- 57.669

A pazi sirotog Tixija koji dramatičan graf postavlja.

Roknula funta prema dolaru, od 1.1075 na katastrofalnih 1.1000, što predstavlja pad od grandioznih 0.64%.

Na koju foru filoputin završi osnovnu školu? Pošalje kozlića pa dobije sjajnu ocjenu iz matetamtike?

Roknula funta prema dolaru, od 1.1075 na katastrofalnih 1.1000, što predstavlja pad od grandioznih 0.64%.

Na koju foru filoputin završi osnovnu školu? Pošalje kozlića pa dobije sjajnu ocjenu iz matetamtike?

Тихи

Starosedelac

- Poruka

- 186.823

A pazi sirotog Tixija koji dramatičan graf postavlja.

Roknula funta prema dolaru, od 1.1075 na katastrofalnih 1.1000, što predstavlja pad od grandioznih 0.64%.

Na koju foru filoputin završi osnovnu školu? Pošalje kozlića pa dobije sjajnu ocjenu iz matetamtike?

Pucaju ti penzioni ustaski fondovi u UK

To ce citavu UK ekonomiju povuci u propast

ljubota

Veoma poznat

- Poruka

- 12.122

Ma samo nek si živ,zdrav i ovako nikad nisi bio...Pucaju ti penzioni ustaski fondovi u UK

To ce citavu UK ekonomiju povuci u propast

Pričali su neki da si umro kada su Ukrajinci srušili Krimski most

sin Juga

Veoma poznat

- Poruka

- 10.053

radeta62

Buduća legenda

- Poruka

- 43.063

Raspade se i kraljica. pirgaci pucaju po svim savovima.

pirgaci pucaju po svim savovima.

spavach

Poznat

- Poruka

- 9.217

i tako, ode kwarteng...a trebala bi isto po tom receptu i liza da sjasi sa stolice..