sin Juga

Veoma poznat

- Poruka

- 10.053

Ал су пукли, баш волим.

Donji video prikazuje kako da instalirate aplikaciju na početni ekran svog uređaja.

Napomena: This feature may not be available in some browsers.

Strasno su pukli! Poskupeo im prasak za buve 2,5%....Ал су пукли, баш волим.

Пробај да користиш капи за буве, мој пас нема проблем.Strasno su pukli! Poskupeo im prasak za buve 2,5%....

Ja nemam buva, ja zivim u Americi.Пробај да користиш капи за буве, мој пас нема проблем.

finansijer nikad nece reci dosta, finansijer i ne zeli da se dug vrati, on samo zeli da si duzan i da radis za njegaReal US debt levels could be 2,000% of economy, a Wall Street report suggests

Total potential debt for the U.S. by one all-encompassing measure is running close to 2,000% of GDP, according to an analysis that suggests danger but also cautions against reading too much into the level.

- Total U.S. debt including all forms of government, state, local, financial and entitlement liabilities comes close to 2,000% of GDP, according to AB Bernstein.

- The biggest potential load comes from entitlements, but is being pressured from rising levels of federal government debt as well.

- The warnings about potential debt hazards come as the total federal debt outstanding has surged to $22.5 trillion.

- A debt reform advocate says now is the time for the U.S. to tackle the issue, before recession hits.

AB Bernstein came up with the calculation — 1,832%, to be exact — by including not only traditional levels of public debt like bonds but also financial debt and all its complexities as well as future obligations for so-called entitlement programs like Social Security, Medicare and public pensions.

Putting all that together paints a daunting picture but one that requires nuance to understand. Paramount is realizing that not all of the debt obligations are set in stone, and it’s important to know where the leeway is, particularly in the government programs that can be changed either by legislation or accounting.

WATCH NOW

VIDEO03:32

Harvard’s Douglas Elmendorf on how good fiscal policy could mitigate the next recession

“This conceptual difference is important to acknowledge because this lens is often used by those who wish to paint a dire picture about debt,” Philipp Carlsson-Szlezak, chief U.S. economist at AB Bernstein, said in the report. “While the picture is dire, such numbers don’t prove we are doomed or that a debt crisis is inevitable.”

Crisis measures cut both ways — sometimes a seemingly smaller level of debt can cause outsized problems during times of economic stress, such as during the financial crisis. And larger levels of debt can be sustained so long as other conditions, like leverage levels, or debt to capital, are manageable.

The key is not always gross dollar amount but rather ability to pay.

“U.S. debt is large. And it’s growing. But if we want to think about debt problems (in any sector – sovereign, households, firms or financials) the conditions rather than the levels are more significant,” Carlsson-Szlezak said. “Debt problems could, arguably would have, already happened at lower levels of debt if the macro conditions forced it.”

‘Profoundly negative effects’

The warnings about potential debt hazards come as the total federal debt outstanding has surged to $22.5 trillion, or about 106% of GDP. Excluding intragovernmental obligations, debt held by the public is $16.7 trillion, or 78% of GDP.

That latter total, considered to be more relevant as an economic burden, is likely to rise to 105% by 2028, according to Congressional Budget Office projections. However, the CBO notes that the numbers are subject to revision depending on how government policies play out.

Advocates for fiscal reform argue that the debt impact has indeed reached the point where action is necessary.

“Globally, we have become over-reliant on borrowing as a solution for everything. Political excuses abound for why it doesn’t matter, which just clearly isn’t the case,” said Maya MacGuineas, president of the Committee for a Responsible Federal Budget, a bipartisan committee of legislators, business leaders and economists that counts former Federal Reserve Chairs Paul Volcker and Janet Yellen among its members.

“We are quickly approaching a situation where we have dug ourselves a debt hole which is doing to have profoundly negative effects on the economy for probably decades going forward,” MacGuineas added.

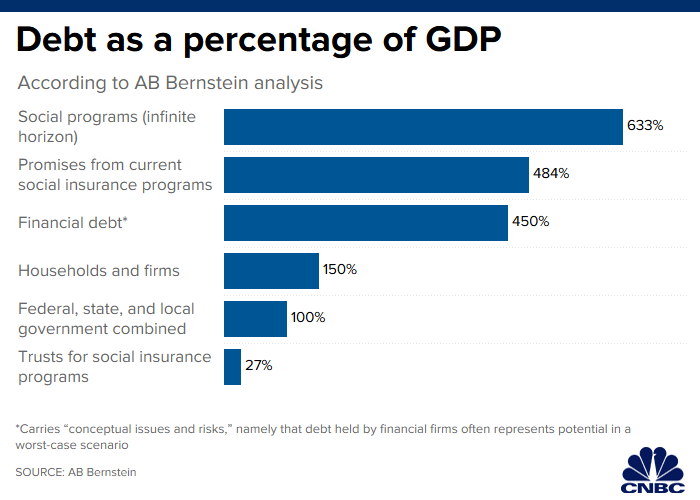

In its calculations, AB Bernstein pulls in debt from a variety of sources and compares it to GDP as follows:

- 100% of GDP using federal, state and local government debt combined.

- 150% for households and firms

- 450% for financial debt, which carries “conceptual issues and risks,” namely that debt held by financial firms often represents potential in a worst-case scenario involving various derivative instruments that can carry high notional levels that are unlikely ever to be realized.

- 27% in trusts for social insurance programs.

- 484%, which values all the promises from current social insurance programs.

- 633%, which tallies up an “infinite horizon” of obligations for social programs, rather than just the traditional 75 years used in computations.

Timing is everything

That total gets the debt load around the 2,000% mark, though Carlsson-Szlezak points out that different debt carries different risks.

“A default on U.S. treasury bonds would be catastrophic to the global economy – whereas changes in policy (while painful for those whose future benefits were diminished) would barely register on the economic horizon,” he wrote.

Impacts on individual parts of the economy would vary.

Moody’s Investors Service recently warned that an already growing number of junk-rated companies could “swell dramatically” in the next downturn, “substantially increasing default risk.”

“In the next credit cycle downturn, then, the generally lower credit quality of today’s speculative-grade population means that the default count could exceed the Great Recession peak of 14% of all rated issuers,” Christina Padgett, a Moody’s senior vice president, said in a statement.

Currently, though, credit default rates remain low as economic conditions prove favorable.

Similarly, on a macro level recession fears have proven unwarranted so far as growth continues albeit at a slower pace than in 2018. McGuineas of the CRFB said that now is the time then for the country to start doing something about the debt situation.

“First, you start having politicians level with voters instead of promising freebies. Second, you recognize that the time to do that is when your economy is strong,” she said. “When people were arguing for more borrowing they should have been doing the reverse. We’re still not in recession. It’s time to put in long-term strategies.”

https://www.cnbc.com/2019/09/09/rea...cking-2000percent-of-gdp-report-suggests.html

Pitanje je samo kad ce prdnuti u cabar i finansijer americkog duga reci - dosta.

glup si ti za te diskusije, bolje da cutisAjd joj naplati ako mozes i smes? Lupi sankcije mozda?

glup si i ti za te diskusije.onaj kom je duzna sigurno ima poluge kako da naplatidužni su dr. Jovani

prvi pravi korektan odgovorСве тврдње о скорој пропасти Америке су засноване на Марксовој теорији економије капитализма коју је презентовао у својој књизи "Критика Капитала". То више не важи! Увођењем новца без подлоге су правила промењена и још увек није дефинисана нова теорија и за сада је једино ограничење физичка коначност ресурса као што су нафта, гас, руде итд..

i to je korektan odgovor, ali sad su narasli neki novi klinci, nije pozeljno uci u rat sa njima.hoce i oni deo kolaca. vek i po nisu sa nikim delili, videcemo kako ce sada biti

a ti si kao pametan? postavi ti nesto pametno umesto tixija, pa da diskutujemo, a ne da etiketiras forumase. SVETO DOLAZI, ovaj opet vileniTihomir se izdaje za dipl ecc koji pre neki dan nije znao ni izbliza da objasni pojam "tržište". Izvalio je da je tržište isto što i kupci, i da oni jedini određuju cenu. Popadali smo u nesvest.

Dalje zaključi sam.

jos jedno mandovce sto je naucilo engleski i umislilo da je amerikanac? cuvaj se da te ne zamene za MEKSIKANCA kad dodje do krizeDug jedva iznosi 0.0063% buduće američke ekonomske moći.

Ako je dug planske ekonomije u Japanu 250% BDP-a, a američki 100%, to samo znači da mi olako možemo podneti 850% uz Protestantsku Etiku i Duh Smitonizma.

Meanwhile, Rusija odašilja suprotne signale. Njen dug je jedva 19% BDP-a što znači da niko živ na kugli zemaljskoj Rusima ne da više od $100 mesečno na veresiju.

nije to samo u americiТај њихов дуг не може да се отплати. А и не мора да се отплати.

Због чега би отплаћивали?

Банкари и други моћници који држе под контролом Сједињене Америчке Државе су баш ти којима се дугује.

Банкрот државе би значио и банкрот тих моћника. А докле год постоји тај дуг, постоји и контрола над државом.

kolaps je malo teska rec,ali da vise nisu jedini hegemon na svetu je sve ocitiji. nekad su sve grabili za sebe, a sada moraju da dele. smatras li to za korak napred ili su uradili nekoliko koraka unazad? nije isto kad si milioner, a padnes na to da moras razmisljati kako dalje ziveti, ja to pomalo smatram da propadasНама је то можда несхватљиво, али код Американаца је одувек постојао велики број бескућника.

У реду, можда су сад у питању рекордни бројеви, али није баш да они драстично расту сваког трена.

Као што рекох за инфлацију, исто важи и за ово. Треба још доста времена да прође, пре него што се дође до критичне ситуације.

Смешни су ми више ови наслови ''Америка је пред колапсом!'', и томе слично. А заправо, тај колапс може да се деси и за 50 година, наравно у случају да се ништа не предузима поводом тога.

potpuno se slazem, do sada su to mogli sa celim svetom, ali vise nisu to u mogucnosti. kako mislis da ce to dalje teci?Е па ту је већ ствар то што је Американцима покриће војска која је у способности да буквално ратује са целим светом. Где ћеш веће покриће, него кад је неки ентитет у способности да само путем тајних служби сруши твоју државу?

Американци су у могућности да праве своје услове, и да креирају сами покриће.

znaci da je pametniji od tebe, SLUSAS GA i verujes mu?To si trtljao i 2011.: propade čemerika, pitanje meseci!

kupuj za tebe i tvog jarana, jos je jeftinStrasno su pukli! Poskupeo im prasak za buve 2,5%....

ko onomad na crnu goru ?Nikako da shvatite da Amerika nije banana republika koju brine visina duga. Oni taj dug, KAD GOD ZAZELE, prebace na ledja drugih drzava!

znaci da je pametniji od tebe, SLUSAS GA i verujes mu?

samo ih slusam . amerika jaka jer ima oruzje,ko sme da trazi od nje dug? samo se pitam hoce li na rotsilde bacati atomke? amerika najjaca jer je duzna celom svetu, a ja sam mislio da je najjaci onaj kome su svi duzni. nije rotsild najjaci jer je duzan, jak je jer su njemu svi duznii pogodi bogami.

Mozes li ti da prevedes to u kratkim crtama?